The market overview was prepared by analysts from the Association of Financiers of Kazakhstan (AFK).

Currency Market

In the last trading session of January, the national currency strengthened slightly: the USD/KZT pair dropped to 518.20 tenge per dollar (-0.99 tenge). The national currency is largely supported by domestic factors, including additional foreign currency supply in the local market due to the mandatory sale of 50% of export revenue from KGS, conversion of transfers from the National Fund, mirroring gold purchase operations, and measures to reduce demand for foreign currency, including maintaining a high base rate by the National Bank of Kazakhstan (NBK) and tightening legislation to curb speculative currency operations. Market participants may have sold foreign currency in anticipation of today's publication of foreign currency sales volumes from the National Fund for February and inflation data for January.

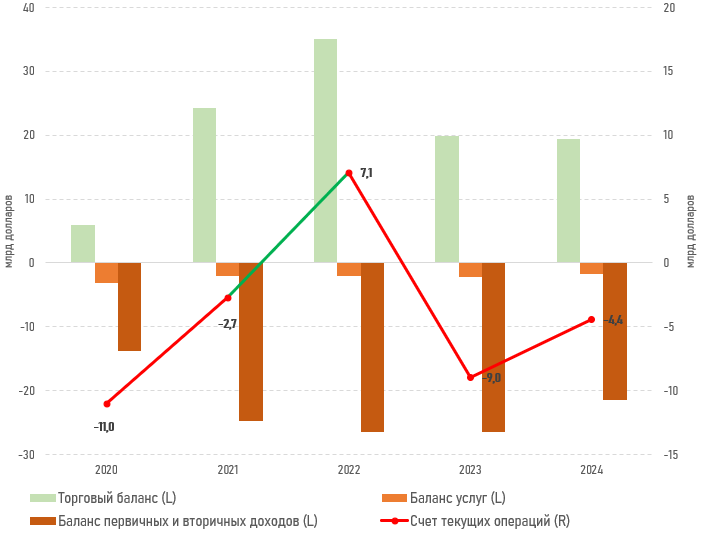

Meanwhile, the National Bank published a preliminary estimate of the balance of payments for 2024: the current account deficit was halved, from $9.0 billion to $4.4 billion, primarily due to a decrease in primary income from foreign direct investments (-$4.4 billion). The negative current account balance is a fundamental factor putting pressure on the national currency and was mainly financed from NBK's reserve assets ($1.1 billion), a positive value of errors and omissions ($2.5 billion), as well as a small inflow from the financial account ($0.7 billion).

Diagram 1. Current Account of RK:

Source: NBK

Money Market

Indicative money market rates rose slightly on Friday: the yield on overnight repo operations increased to 14.58% per annum (+17 bps), while liquidity attraction through currency swap operations cost market participants 10.76% per annum (+33 bps). The total trading volume remained low at 537.7 billion tenge.

Meanwhile, on Wednesday, the NBK placed 753 billion tenge (100% of demand) at a yield of 15.25% per annum during the deposit auction. Against this backdrop, the open position grew to 7.8 trillion tenge in market debt.

Stock Market

After five consecutive sessions of decline, the KASE index rose on Friday to 5,644.4 points (+0.13%). The main drivers of growth were stocks in the banking sector: Halyk Bank (+0.8%) and BCC (+0.4%). Demand for these securities may have been supported by strong financial results for 2024.

Oil

Brent crude oil prices fell on Friday to $76.8 per barrel (-0.84%), and as of now, they are decreasing to $76.2 (-0.7%). Market concerns arise from the potential consequences of the newly initiated trade war by the White House administration for the global economy and future demand for raw materials. Additionally, the U.S. is imposing a lower tariff of 10% on Canadian oil.

Risky Assets

Risk appetite worsened on Friday due to news about the inevitability of trade wars initiated by the new White House administration. On Saturday, U.S. President Donald Trump imposed tariffs of 25% on Mexico and Canada and 10% on China. Canada and Mexico have already stated they will take retaliatory measures, while China will file a complaint with the WTO and protect its rights and interests. High tariffs could provoke trade wars, lead to rising prices and necessitate high interest rates, as well as an overall decline in corporate profits. Against this backdrop, futures for major U.S. stock indices are down by 2.1-2.8%.

Market sentiment in the coming days, aside from the developments regarding trade wars, may be influenced by the publication of the monthly labor market report, weekly claims for unemployment benefits, the industrial production index, and corporate earnings reports.

Defensive Assets

Amid rising concerns over the onset of trade wars, interest in certain risk-free instruments has significantly increased. Thus, the U.S. dollar index strengthened by 0.5% on Friday, and at one point, it added another 1.3%. Significant fluctuations in the quotes for defensive assets may be observed throughout the week.