European Bestsellers of 2024

The Dataforce agency has released a ranking of the most popular models in the European market for 2024. This ranking includes sales not only in the European Union but also in Iceland, Norway, Switzerland, Liechtenstein, and the United Kingdom.

The budget Romanian hatchback Dacia Sandero achieved a convincing victory with 270,111 units sold. The silver medal went to another affordable model - the Renault Clio hatchback, which sold 216,569 units. The Volkswagen Golf, celebrating its 50th anniversary, came in third, trailing Clio by just 20 units: 216,549 units.

In fourth place is the Tesla Model Y crossover (210,484 units), which was the absolute leader in Europe the previous year. Due to the cancellation of subsidies and a cooling interest from Europeans towards electric vehicles, sales of the Model Y dropped by 17.5%. Rounding out the top five is the compact SUV Volkswagen T-Roc (203,611 units): sales decreased only by 1.5%, but that was enough to push it out of the top three, where it was in 2023. Finally, the European bestseller of 2022, the Peugeot 208 hatchback, found itself in sixth place this time with 199,820 units sold.

Results of the Chinese Auto Market: Volumes and Profits

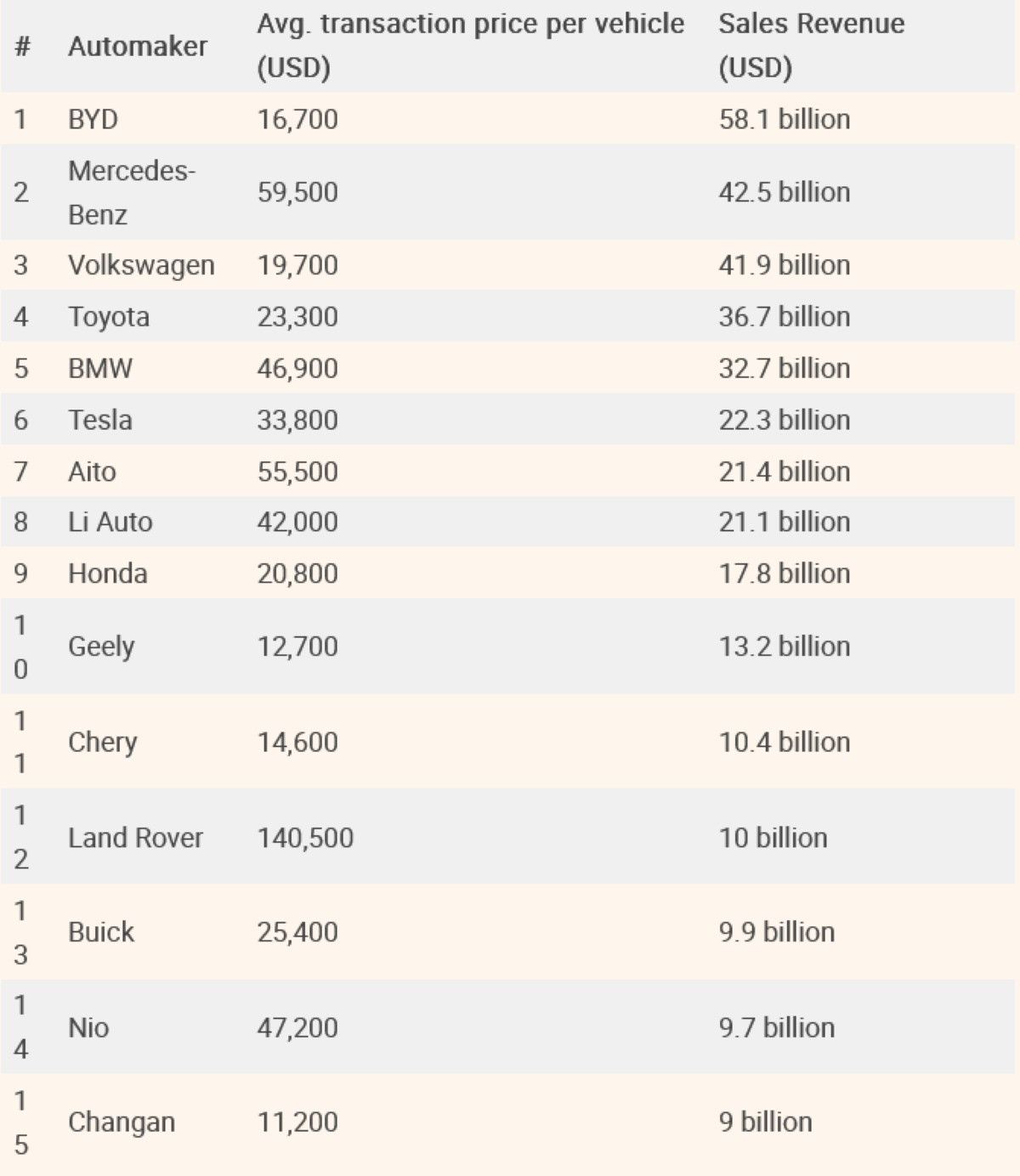

China retains its title as the largest automotive market in the world: last year, 31.4 million new cars were sold there (an increase of 4.5%). However, the financial performance of the companies operating there is also noteworthy. The agency Sina Finance prepared this statistics for 2024, and a quick glance reveals just how significant the Chinese market is for foreign manufacturers.

The local conglomerate BYD secured first place by a significant margin. It managed to sell 3.49 million vehicles in its home market, with sales revenues reaching 58.1 billion dollars. This indicates that the average selling price of a BYD is relatively low — 16,700 dollars. In second place, Mercedes-Benz delivered 710,000 cars to Chinese customers, generating 42.5 billion dollars in revenue. Thus, the average price of a Mercedes in China is 59,500 dollars. The residents of the Middle Kingdom are slightly more favorable towards fully imported Land Rover vehicles (10 billion dollars), which have an average price of 140,500 dollars.

Rounding out the top three is the Volkswagen Group, with 41.9 billion dollars. Considering the 2.13 million cars sold, their average price was 19,700 dollars. Even the premium brand Audi, which sold 660,000 vehicles (included in the overall total) at an average price of 41,000 dollars, could not help, generating 27 billion dollars in revenue.

Besides BYD, the Chinese automaker Aito, created by Huawei and Seres, performed excellently. A total of 390,000 vehicles were sold at an average price of 55,500 dollars, ensuring earnings of 21.4 billion dollars and securing seventh place in the ranking. Following closely is Li Auto, which sold 500,500 units at an average price of 42,000 dollars, resulting in revenues of 21.1 billion dollars. Geely, Chery, and Changan also made it into the top 15.

Anti-China Tariffs in Europe: Initial Lawsuits

Chinese companies Geely, SAIC, and BYD have filed a lawsuit against the European Commission to overturn additional tariffs on electric vehicles from China. Interestingly, they were joined by German BMW, whose CEO Oliver Zipse is a staunch opponent of anti-China tariffs in Europe. He believes that the prosperity of the German economy is based on open markets and free global trade. Additionally, BMW imports electric Mini vehicles from China.

Shortly after, American Tesla joined the initial quartet. Elon Musk's company imports popular Model 3 sedans from China to Europe, which are now subject to an additional 7.8% tariff (on top of the basic 10%). This is not a significant amount compared to the 35.3% surcharge imposed on SAIC. However, such a levy still means reduced profits, and Elon Musk himself is known as one of the main critics of the European Union authorities.