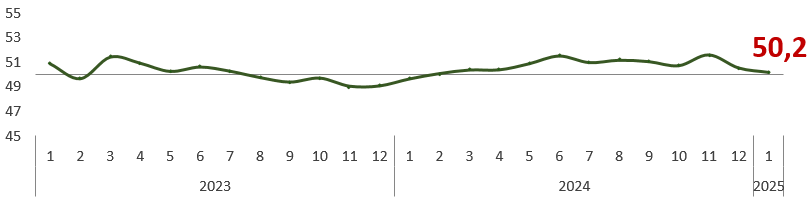

In January 2025, business activity slowed down, yet the index remains in positive territory since February of last year, standing at 50.2. This was reported by Rustem Orazalin, the director of the monetary policy department at the National Bank, as conveyed by a correspondent from the business information center Kapital.kz, referencing the monetary regulator's press service.

The slowdown in the index was attributed to a decrease in business activity in manufacturing and services, which fell to 49.9 and 49.7, respectively (down from 50.4 and 50.2 in December 2024), resulting in the index shifting into negative territory. The only sectors that remained in positive territory were trade and construction, with figures of 51.6 and 51.2, respectively (compared to 52.1 and 53.9 in December 2024). In the mining industry, despite a slight increase to 49.9 (up from 48.3), the index still remains in negative territory.

The business climate index (BCI) in January 2025 showed improvement. Both current and future business conditions assessments have improved. Consequently, the business climate index rose to 12.8. The "hours" indicator of the business cycle remained in the growth zone.

According to the assessments from enterprises, demand for their products and services has increased. Despite the slowdown, the highest demand was noted in construction. Overall economic demand is showing growth, but there are mixed changes across different sectors. Respondents positively noted changes in infrastructure; however, other factors (business protection issues, tax burden, and access to finance/credit) were rated negatively, particularly the evaluation of the tax burden has worsened.

Recall that during an extended government meeting with the participation of the president on January 28, Vice Prime Minister and Minister of National Economy Serik Jumangarin proposed lowering the VAT threshold to 15 million tenge. Prime Minister Olzhas Bektenov stated during the meeting the necessity of increasing the VAT rate while reducing social tax and mandatory pension contributions from employers.

“The main tax burden falls on the wage fund, which means it affects the cost price. Even before the goods hit the shelves, the entrepreneur is already forced to pay a large portion of taxes. The government proposes to reduce the burden on the wage fund by transferring it to sales. To achieve this, it is necessary to raise the VAT rate while simultaneously lowering the social tax and mandatory pension contributions from employers,” said Olzhas Bektenov.

Currently, the issue of increasing the VAT rate from 12% to 20% is being considered in Kazakhstan.