Last week, the "first cryptocurrency" reached a new all-time high before declining in value due to political events and economic news, reports a correspondent from the Kapital.kz business information center.

On January 20, 2025, Bitcoin set a new record, hitting $109,000. However, the festive mood among market players was dampened by Donald Trump's inaugural speech, in which he did not mention cryptocurrencies. The price of Bitcoin dropped sharply to $100,500, a decrease of 6% from its recently established peak. This decline can be attributed to investors' expectations that the new U.S. president might somehow support or mention cryptocurrency in his speech. This did not happen, leading to a wave of selling and profit-taking. In the following days, the price of Bitcoin managed to reach $104,466 (as of the time of writing - Ed.). This recovery can be partially explained by market correction following the sharp drop, as well as news about the launch of new Bitcoin spot ETFs in Asia and overall optimism regarding institutional interest in cryptocurrencies. Thus, the last seven days have been a period for Bitcoin to showcase its growth capabilities, despite significant fluctuations caused by political expectations and real events.

$TRUMP

A new meme coin, $TRUMP, also emerged last week. Initially, market players considered its creation a joke or a scam. It soon became clear that the project was linked to Donald Trump. This confirmed the legitimacy of the asset and sparked a surge of interest from both investors and critics. The token was launched on the Solana blockchain, providing high speed and low fees for transactions. The project’s website states that 80% of the tokens are owned by The Trump Organization and Fight Fight Fight LLC. Since its launch, $TRUMP has shown impressive price volatility, typical for meme coins. Starting at $0.17, the token quickly soared to $8.69 within the first hours after launch, peaking at $74.59 by the evening of January 19. At the time of writing, the asset's price has fallen to $38. This dynamic has caught the attention of traders. Analysts noted that such price behavior is expected for a new meme coin, especially with such a political connection, but they also warned of the risks associated with investing in such assets. Critics of the project point to ethical and regulatory aspects, while supporters view it as a new chapter in the history of cryptocurrencies. The launch of $TRUMP has become not only a financial but also a cultural event, prompting reflection on the future relationship between politics and technology. It remains to be seen whether investors will assess the project as speculative or as the beginning of a new era in the cryptocurrency world.

Following the launch of Donald Trump's meme coin, the total daily turnover on decentralized exchanges (DEX) in the Solana network surged sharply, reaching approximately $27.0 billion, allowing this ecosystem to outpace Ethereum, where this figure was recorded at $5.0 billion. DeFi enthusiasts from the Pink Brains studio emphasized that before such a significant jump, Solana platforms were averaging around $5.0 billion in daily transactions. As a result, the overall ratio of DEX trading to turnover on centralized exchanges (CEX) rose to 19%. Blockworks analyst Dan Smith reported that on January 18, the trading volume in Solana amounted to $28.2 billion, and on January 19, it skyrocketed to $39.2 billion. The largest portion of this amount came from trading tokens linked to the Trump family ($12.0 billion), the SOL/USD pair ($12.9 billion), and stablecoin exchanges ($1.5 billion). This surge in liquidity contributed to the rapid appreciation of Solana, ultimately allowing this digital asset to overtake Binance Coin and secure the fourth position in the rankings.

Knife Fight

Experts have also turned their attention to the future of the largest cryptocurrency by market capitalization. Technical analyst Peter Brandt stated that by the end of 2025, the price of Bitcoin could reach $120,000-150,000; however, he also suggested the possibility of a peak formation followed by a decline of approximately 50%. He justified his scenario using Bayesian probability, emphasizing that with a large statistical sample, random events often occur, and he drew conclusions based on years of experience.

“Am I hedging my bets? Of course. Awareness of risks is a result of my 50-year trading career,” he stressed, adding that in mid-January he referred to the situation around Bitcoin as a “knife fight.” At that time, the chart indicated a potential correction to the $74,100 zone or a new all-time high around $116,600.

DOGE

Amid discussions about the long-term prospects of the cryptocurrency, news also emerged regarding a new structure in the U.S. sharing the same name as Dogecoin. The Department of Government Efficiency under the U.S. government (DOGE) published the Dogecoin logo on its official website. So far, only a one-page version of the portal has been created, displaying the agency's name, the dollar symbol, and the slogan: “The people have voted for major reforms.”

These events triggered a brief spike in the price of DOGE to $0.4, after which the quotes experienced a slight decline, retreating to approximately ~$0.38. According to the decree establishing the DOGE agency, its key task will be “to modernize federal technologies and software to maximize the efficiency and productivity of government administration.”

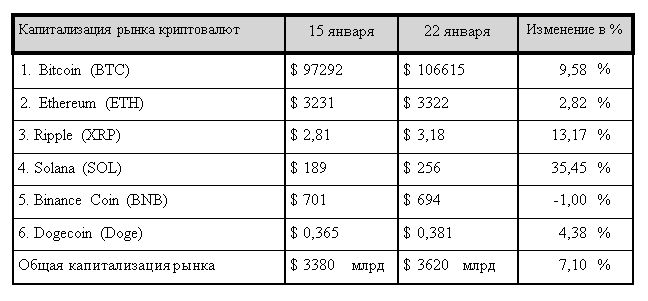

At the end of the seven-day reporting period, the total market capitalization of cryptocurrencies managed to rise above the psychological threshold of $3.5 trillion. As of the evening of Wednesday, January 22, 2025, it stood at $3.62 trillion, which is 7.1% higher than the values recorded at the end of the previous reporting period.

1. Bitcoin (BTC). As of the evening of Wednesday, January 22, 2025, the price of “digital gold” was recorded at $106,615, having increased by 9.58% over the week. Bitcoin's share in the overall market capitalization rose by 0.71 percentage points, reaching 57.73%. This underscores the growing interest of investors in the main crypto asset against the backdrop of recovering market sentiment.

2. Ethereum (ETH). As of the evening of Wednesday, January 22, 2025, the price of Ethereum was $3,322, having risen by 2.82% over the week. However, the share of ETH in market capitalization decreased by 0.58 percentage points, to 10.93%. This may indicate a partial redistribution of investor interest in favor of other altcoins.

3. Ripple (XRP). As of the evening of Wednesday, January 22, 2025, the price of XRP rose to $3.18, an increase of 13.17% during the reporting period. XRP's share in market capitalization increased by 0.22 percentage points to 5%. This reflects high demand for the asset under current conditions.

4. Solana (SOL). As of the evening of Wednesday, January 22, 2025, the price of Solana (SOL) was $256, having increased by 35.45% over the week. The share of SOL in the total cryptocurrency market capitalization rose by 0.69 percentage points to 3.4%. This highlights the increasing interest of investors in this asset.

5. Binance Coin (BNB). As of the evening of Wednesday, January 22, 2025, the price of Binance Coin (BNB) decreased to $694, down 1% over the week. The share of BNB in market capitalization fell by 0.26 percentage points, reaching 2.73%, indicating a short-term correction amid the rise of other assets.

6. DogeCoin (Doge). As of the evening of Wednesday, January 22, 2025, the price of Dogecoin (DOGE) increased by 4.38% or $0.381 over the week.