Last week, the cryptocurrency market experienced an unprecedented shock. On February 3, the U.S. administration announced the implementation of new tariff measures, leading to a rapid decline in digital asset prices, as reported by a correspondent from the Kapital.kz business information center.

Additional tariffs of 25% on imports from Canada and Mexico, as well as 10% on products from China, were introduced at the initiative of Donald Trump. Following this, the market capitalization of the cryptocurrency sector fell by 11.7%, reaching $3.16 trillion. The price of Bitcoin briefly dropped to $91,281, then sharply recovered to around $94,500, before starting to fluctuate again. Many altcoins also suffered significant losses. Ethereum briefly fell below $2,400, then rose to $2,600, while XRP lost over 20% of its market cap, dropping below $2, but soon rose back above $2.5.

Largest Liquidation

Such a massive price drop triggered the largest liquidation in the history of the crypto market. According to CoinGlass, forced position closures reached $2.27 billion, with the highest liquidation volumes occurring in ETH ($615.72 million), BTC ($417.77 million), and XRP ($123.3 million). ByBit co-founder Ben Zhou noted that the actual liquidation amount could have reached at least $8 billion, highlighting the unprecedented scale of the event. Economist Alex Krüger emphasized that the introduced tariffs were much harsher than market participants had anticipated and negatively impacted not only the stock markets but also the U.S. economy as a whole. He stated that the situation was particularly unfavorable for risky assets like Bitcoin; the further dynamics will largely be determined by the news background and could develop in any direction. Alex Krüger did not rule out that the market had either already formed a local bottom or that Bitcoin would retest the $90,000 area. He suggested that the responses from U.S. trading partners would not be excessively harsh and that agreements on tariff reductions could be reached soon. Against this backdrop, the Prime Minister of Canada announced plans to introduce mirror tariffs on American goods worth approximately $105 billion, while Mexico prepared its own response. This situation further heightened uncertainty in the market. The U.S. President stated his intention to negotiate with leaders of neighboring countries by February 3, 2025, while the introduction of new tariffs remained scheduled for February 4, 2025.

Strategic Bitcoin Reserve

Simultaneously, market participants and analysts turned their attention to legislative initiatives related to the establishment of a strategic Bitcoin reserve. Expert Dennis Porter, head of the Satoshi Action Fund, stated that the state of Utah might become the first in the U.S. to pass a law for such a reserve. The legislative process in Utah takes only 45 days, which sets this state apart from others. In Arizona, the corresponding bill has already passed discussion in the relevant committee and will soon be put to a vote in the Senate. Similar documents have been submitted in other states. According to Dennis Porter, all bills previously approved by the Utah House of Representatives' Economic Development Committee have invariably become law, instilling confidence in the potential approval of the initiative at both regional and federal levels.

Senator Cynthia Lummis reported that work on creating a national strategic Bitcoin reserve began with an eye toward bipartisan support in the Senate, which will require securing at least 60 votes. Representatives from VanEck suggested that implementing such a reserve could allow the U.S. to reduce its national debt by 35% by 2050.

Analysts from Fidelity Digital Assets noted that the potential acceptance of Bitcoin at the state level in 2025 could serve as a powerful catalyst for growth in the entire digital asset market.

Mirage in the Desert

In addition to legislative initiatives, other significant events occurred in the crypto space. The meme coin TRUMP lost 75% of its value from its historical peak reached on January 19, 2025 (around $75.35), dropping to approximately $17. The token MELANIA, also related to themes involving the president's family, fell 90% from its peak of $15.5 to about $1.42. The sharp deterioration in market conditions prompted criticism of the Donald Trump administration. Former team member and founder of SkyBridge Capital, Anthony Scaramucci, stated that promises to ease regulations for the crypto industry were merely an illusion, comparing them to a mirage in the desert. He emphasized that the crypto community, previously full of optimism ahead of the change in power, ultimately faced serious disappointment. Against this backdrop, major institutional players began reassessing their strategies. MicroStrategy, the largest corporate holder of Bitcoins, temporarily halted large purchases of "digital gold" from January 27 to February 5, 2025. The company currently holds 471,107 Bitcoins, acquired at an average price of about $64,511 per coin, totaling an estimated value of approximately $30.4 billion. Co-founder Michael Saylor confirmed that during this period, MicroStrategy would not sell any shares under its market offering program and urged investors to "never part with their Bitcoins."

The market rebound occurred as sharply as the decline. On the night of February 4, 2025, the price of Bitcoin recovered to $100,000 after U.S. authorities decided to delay the increase in tariffs on imports from Mexico and Canada by 30 days. Successful negotiations between the leaders of these countries and the U.S. President facilitated this decision. However, the 10% tariffs on Chinese goods remained in effect, continuing to negatively impact both the stock market and the cryptocurrency space, which slowed the pace of Bitcoin's price rebound. Ethereum, meanwhile, rose by 7.8%, reaching approximately $2,800, while assets like Cardano and XRP showed even more impressive recovery results.

Analytical data from TradingView and CoinGecko confirmed that despite the uncertainty, investors anticipated stabilization and further market growth.

The crypto community's attention was drawn to a recommendation made by Eric Trump, the President's son, on February 4, advising to buy Ethereum, considering this moment opportune for increasing ETH's share in portfolios.

The "Cleansing" of the Crypto Market

Amid ongoing volatility, analysts paid special attention to the excessive use of borrowed funds in the market. CryptoQuant specialists noted a significant "cleansing" of the crypto market from excessive leverage, reflected in a sharp reduction in funding rates for perpetual contracts and mass liquidations. A similar situation was observed in August 2023 when Bitcoin briefly fell to $93,000, and the premium on Coinbase turned negative. Analysts suggested that this reduction in speculative pressure could help foster a further bullish trend: Glassnode metrics also recorded negative funding figures. According to CryptoQuant specialists, despite the current volatility, the market structure retains the prerequisites for a continued bull run. They believe that Bitcoin's "fair" value is around $87,990.

Standard Chartered's forecasts indicated that in the next two months, Bitcoin could reach a range of $112,000 to $130,000 due to accelerated inflows from institutional investors and a shift in sentiment towards risk acceptance. Analyst Michael van de Poppe, founder of MN Trading, noted that despite high volatility, Bitcoin's price could reach a new all-time high in February. He emphasized that as long as the price remains above $93,000, establishing a new ATH remains a realistic scenario. Technical indicators, including a strong rebound from the trendline and an "engulfing" pattern at the support level around $92,000, support this viewpoint. Further momentum was accompanied by another rebound, and CryptoQuant data indicated that each of the last six instances of funding rate moving into negative territory led to bullish movements. Lookonchain, in turn, recorded a trend of decreasing Ethereum value each time Bitcoin tested the $100,000 mark. Analysts at QCP Capital believe that despite local stabilization around $98,000, ongoing uncertainty, including the upcoming press conference of "crypto king" David Sachs and negotiations between U.S. and Chinese leaders regarding trade tariffs, could significantly impact future price dynamics.

Nonetheless, most experts agree that Bitcoin will not only strengthen but also continue to grow, reaching a new historical high in February. A sustainable recovery following a series of large liquidations, according to the expert community, lays a broad foundation for the further development of the cryptocurrency industry. Global economic uncertainty and increasing regulatory pressure continue to exert a significant impact on the market, while its participants seek ways to optimize investment strategies amid heightened volatility. Experts noted that the tightening competition in cryptocurrency regulation motivates countries to seek balanced solutions that ensure the stability of the financial system.

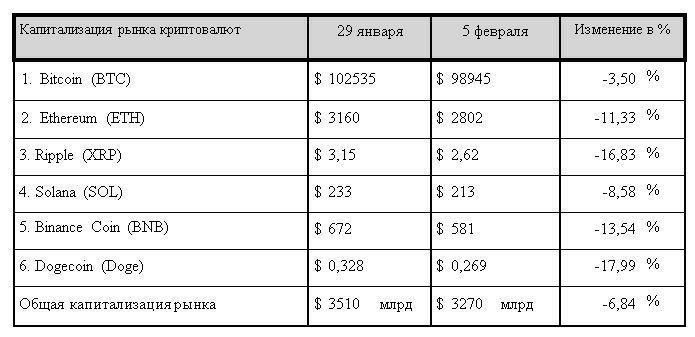

At the end of the seven-day reporting period, the total market capitalization of the cryptocurrency sector, amid turbulence, barely avoided falling below the psychological mark of $3 billion. As of the evening of Wednesday, February 5, 2025, it stood at $3.27 trillion, which is 6.84% lower than the values recorded at the end of the previous reporting period.

1. Bitcoin (BTC). As of the evening of Wednesday, February 5, 2025, the price of