Last week, the cryptocurrency market experienced volatility, primarily driven by a downturn in traditional financial markets, particularly in the U.S. tech stock sector. The decline in these equities was attributed to the rapid success of the young Chinese AI startup DeepSeek, whose achievements triggered a wave of sell-offs that impacted the decentralized finance market, according to a correspondent from the business information center Kapital.kz.

The Edge of Panic

Although Bitcoin briefly dipped below the psychologically significant threshold of $100,000, perceived by many as the "edge of panic," it ultimately made a confident return above this mark. Analysts from Standard Chartered suggested viewing the drop in the leading cryptocurrency, influenced by the DeepSeek factor, as a potential buying opportunity before the market begins to stabilize. They highlighted the "painful correlation" between Bitcoin and the Nasdaq index and reminded investors of the data to be released at the end of January by Microsoft, Meta, and Tesla, as well as the upcoming Federal Reserve meeting. They pointed out that "risks included the continuation of sell-offs in high-tech stocks, which could drive the main digital coin down to key support levels, where the average purchase price of the ETF after Donald Trump's election was $96,400."

Experts noted the uncertainty surrounding the U.S. president's signed decree to establish a working group on digital assets, stating: "Market disappointment arose in two aspects. First, the document referred specifically to 'stocks' rather than 'reserves,' which seemed more related to confiscated rather than purchased assets. Second, further measures required congressional involvement." According to them, against this backdrop, some players reacted with a "loss of hope," and this response reduced the likelihood of a deepening correction while simultaneously preparing the market for a "buying on dips" phase.

Fundstrat co-founder Tom Lee called the sell-off of U.S. stocks on January 27 "an excessive reaction" and urged special attention to the plummeting Nvidia stocks, stating that they provided "the largest opportunity for acquisition since the pandemic." QCP Capital suggested that a return to positive sentiment may not happen without confirmation of the creation of a Bitcoin reserve. Analysts from the company explained that there is already a noticeable skew towards calls in the options market, starting from contracts expiring in March. However, the situation could change if Donald Trump seeks to "emerge as a hero" and mitigate the impact of DeepSeek.

According to experts, the market is cautiously awaiting the Federal Reserve meeting scheduled for the end of January: investors are closely monitoring signs of adjustments in monetary policy, as such changes could reflect on the entire financial sector.

Meanwhile, specialists suggested that "Bitcoin should remain relatively stable as long as its quotes stay within the usual range."

Green Light

On January 28, it was reported that the Arizona Senate Finance Committee approved a bill allowing the state to invest in cryptocurrencies and digital gold. The document was then sent to the upper chamber of Congress's rules committee for establishing the discussion process and amendments. If the project is approved by the entire Senate, it will then be sent to the House of Representatives. Co-founder and CEO of Satoshi Action Fund, Dennis Porter, explained that it was in Arizona where the legislative committee first gave the initiative the "green light." He added that 15 or even 16 states have already shown interest in forming a Bitcoin reserve, whereas similar intentions were almost nonexistent just three months ago.

Bulls Will Continue to Dominate

If bullish sentiments in Bitcoin continue to develop, analysts believe there would be chances to test new local lows. In recent days, it failed to stay above $108,000, which could lead to the formation of a bearish "double top" pattern with a potential drop to $75,000 — this was the assumption of CoinDesk. This pattern has two comparable peaks, between which a trough is observed, and confirmation of the trend change was associated with breaking through the support line. The inability to remain above the previous maximum and the subsequent pullback indicated a weakening of the upward momentum. At the same time, the ~$91,600 level acted as a support line, and if the pattern materializes, the price could drop by an amount equal to the height from the peaks to the indicated line. Overall, leading market participants agreed that "bulls" would continue to dominate. Investors acknowledged that interest in crypto instruments has revived and that there is a need to reactivate in this area following the U.S. presidential elections. This was noted in Bernstein's report. The company's experts emphasized that clients are still not fully clear about what "transformations in the future are expected regarding the regulation of digital assets."

"In reality, it is only the beginning, and investors have just started analyzing cryptocurrencies," analysts emphasized.

They clarified that client interest is currently mainly focused on shares of mining firms and exchanges, as well as factors contributing to Bitcoin's growth.

One branch of the discussion was dedicated to the "destructive impact of stablecoins amid anticipated legislative changes." "Investors expressed curiosity and maintained neutrality towards digital gold, continuing to focus on securities, as they had no opportunity to directly purchase Bitcoin or work through the corresponding ETF," the report stated.

Questions from clients regarding MicroStrategy mainly concerned how the company's purchases affected the Bitcoin market and whether the firm faced risks due to its strategy. However, experts did not share concerns about excessive leverage, indicating that the corporation is capable of issuing additional instruments to expand its Bitcoin pool. They estimate that the total volume of digital gold purchases by various companies, including MicroStrategy, will increase from $25 billion to $50 billion by 2025. From January 21 to 26, MicroStrategy acquired an additional 10,107 BTC for approximately $1.1 billion, corresponding to an average price of around $105,596 per coin. According to the K-8 document, the funds for these acquisitions came from the placement of 2,765,157 shares, with securities worth $4.35 billion remaining available for further sale. By January 29, the company increased its total Bitcoin reserves to 471,107 BTC, having invested $30.4 billion in the first cryptocurrency since August 2020, resulting in an average purchase price of about $64,511 per coin.

5

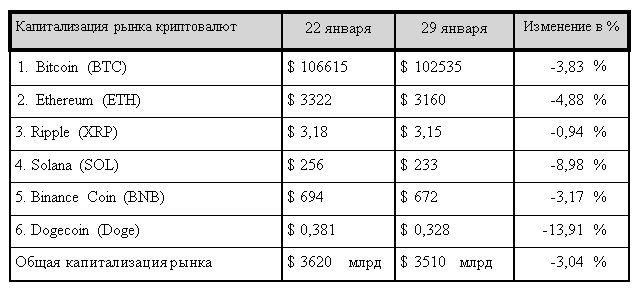

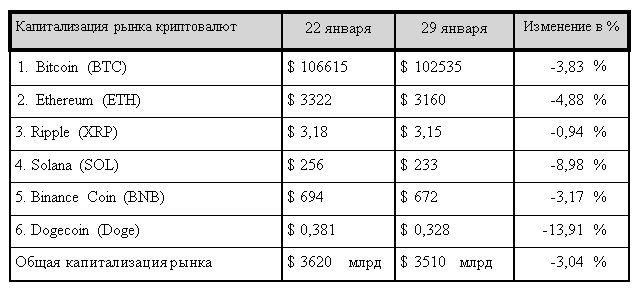

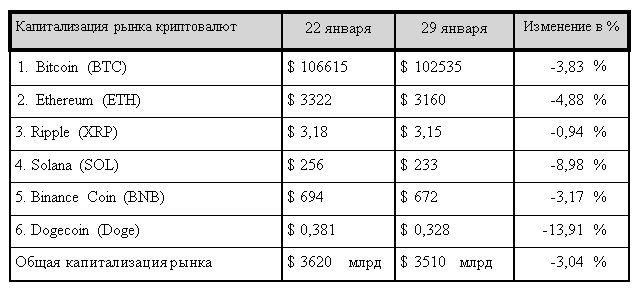

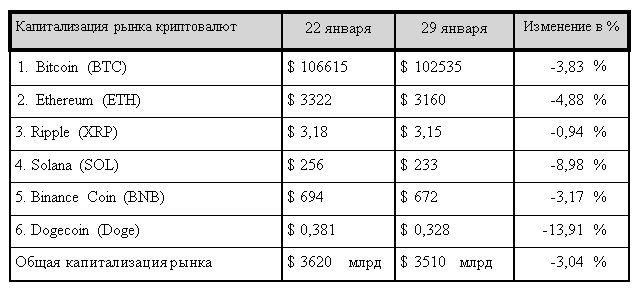

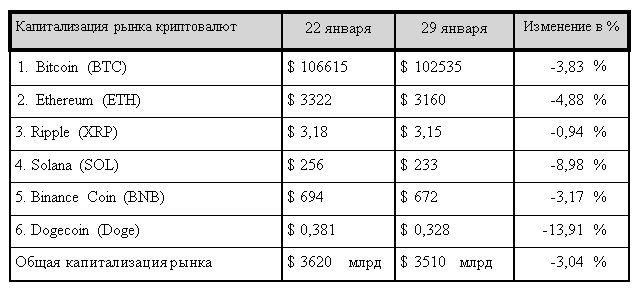

5 By the end of the weekly reporting period, the total capitalization of the cryptocurrency market barely managed to hold above the psychological mark of $3.5 trillion. As of the evening of Wednesday, January 29, 2025, it stood at $3.51 trillion, reflecting a 3.04% decrease from the values recorded at the end of the previous reporting period. Despite the overall price decline, the increase in Bitcoin's share and the growth in the share of some altcoins indicate a continued flow of capital within the market and sustained interest in key digital assets.

1. Bitcoin (BTC). As of the evening of Wednesday, January 29, 2025, the price of "digital gold" fell to $102,535, or a 3.83% decrease over seven days. Bitcoin's share of the total market capitalization rose by 0.57 percentage points to 58.3%. Analyzing the chart, it can be concluded that despite the price drop, capital continues to flow into the main crypto asset, highlighting its relative stability amid the overall market correction.

6

6 2. Ethereum (ETH). As of the evening of Wednesday, January 29, 2025, the price of Ethereum was $3,160, down 4.88% over seven days. The share of ETH in market capitalization decreased by 0.03 percentage points to 10.9%. Chart analysis indicates volatile price movements, with interest in alternative assets slightly shifting from Ether to other altcoins.

7

7 3. Ripple (XRP). As of the evening of Wednesday, January 29, 2025, the price of XRP was recorded at $3.15, losing 0.94% in value over seven days. Ripple's share rose by 0.25 percentage points to 5.25%. According to the chart, XRP's price fluctuations over the week were more pronounced compared to Bitcoin and Ether, and the increase in share may indicate sustained investor interest in the token.

8

8 4. Solana (SOL). As of the evening of Wednesday, January 29, 2025, the price of Solana was $233, down 8.98% over seven days. The share of SOL decreased by 0.12 percentage points to 3.28%. After a period of explosive growth, the Solana market has entered a correction phase but maintains relatively high capitalization among altcoins.

9

9 5. Binance Coin (BNB). As of the evening of Wednesday, January